Health insurance providers often struggle to find quality leads for their business. Even in today’s modern era, many people are not aware of the benefits they can achieve through a reliable health insurance. Effective lead generation for the health insurance industry helps the providers educate people and generate interest in them regarding the advantages of purchasing medical insurance.

The process is quite crucial as most people don’t prioritize health insurance due to a lack of proper knowledge. Additionally, the market competition has increased over time. There are hundreds of service providers in the health insurance industry and some of them also have a robust online presence, which helps them attract more consumers.

In today’s ever-evolving digital age, you need to establish a strong, unique, and memorable online presence for your health insurance business. Such a digital presence can immensely help you seize every possible opportunity to acquire new leads who have the potential to convert into your loyal clients.

Do you know that web searches for insurance have increased by 30% in recent years? Just like any other service, people also conduct online searches to find health insurance solutions. If you think that your health insurance business doesn’t need a digital presence, you may lose many of your potential leads in the future. Here, we will talk about the 11 most effective lead generation strategies for health insurance providers. Read till the end to learn about all the proven strategies that you can implement to ensure the success of your medical insurance business.

What Is Lead Generation for Health Insurance Agencies?

It refers to an online marketing practice to generate interest in people regarding your health insurance services. This practice requires you to attract and convert potential consumers who have shown genuine interest in your medical insurance offerings. Health insurance lead generation makes these prospects trust your services and encourages them to purchase insurance from your agency. It ensures that you attract those consumers who are qualified and will definitely consider your services.

Now, what is a health insurance lead? It refers to someone who shows interest in seeking medical insurance services from a specific provider. For example, someone has seen a Facebook ad or a social media post from your health insurance agency. They feel interested in your insurance offerings and visit your website to learn more. You need to attract him/her through impactful strategies and convert them into a lead for your business.

It’s crucial for you to attract these health insurance leads as they can bring in revenue after you successfully pass them through the sales funnel. Though the process is challenging, there will always be an easier way. Service providers can buy health insurance leads with the help of some popular online platforms. Buying leads is not a great option, but it can save time that you may invest in organic lead generation. Another way is to hire a professional health insurance marketing agency to seek their lead generation services.

A health insurance lead can be ‘hot’, ‘warm’, or ‘cold’ based on their level of interest and likelihood of conversions. Hot leads are highly qualified ones and very likely to purchase health insurance while cold leads are those who have shown little to no interest in your medical insurance products and services. Furthermore, a warm lead is someone who has indicated some interest but needs more nurturing to convert into a client.

Why Health Insurance Providers Invest in Effective Lead Generation?

A health insurance agency can achieve a list of benefits through proper lead generation techniques. From exceptional revenue growth to long-term connection establishment with clients, it offers hundreds of advantages. The following are four major benefits you can leverage through lead generation for health insurance.

1. Increased Sales and Revenue

Qualified leads who have more chances to convert into your painting clients can bring exceptional growth in your sales and revenue. It ensures that you have acquired those who will be your future insurance policyholders. Lead generation techniques positively influence a lead’s decision to choose an insurance plan offered by a specific provider.

2. Growing Client Base

Lead generation is all about increasing interest in potential clients regarding your health insurance business. Once the potential leads find your business and policy offerings reliable, they tend to consider your agency over others. Strategies like social media marketing and search engine optimization broaden the reach of your business and significantly grow your online client base.

3. Better Conversions

Have you ever wondered what will happen if your acquired leads do not convert into your clients? All your lead generation efforts will be of no use. But there is always a solution to a problem. Create lead generation campaigns targeted to those who are interested to buy a health insurance plan or have shown their curiosity to learn more about the related plans. This technique will ensure higher conversion rates for your business.

4. Long-Term Connections with Clients

Effective lead generation allows you to perform social media marketing, email marketing, cold calling, referral building, and many other practices. All these practices require you to have meaningful conversations with your potential leads. You can connect more with them and showcase your expertise as a credible resource. Such interactions foster trust and build long-term relationships between health insurance providers and potential clients.

11 Key Strategies to Attract Qualified Leads for Your Health Insurance Business

There are many high-cost lead generation methods that you can use. But why waste your valuable resources when you have a more affordable alternative to attract highly qualified medical insurance leads? And the alternative is the Internet which you can use in various ways to attract potential leads and influence their decisions to buy health insurance leads from your agency.

When health insurance agents generate leads online, they need to pay a fraction of the initial investment cost as compared to other traditional lead generation strategies. Additionally, the online process doesn’t make you depend on specific business hours to generate leads. You can perform the practice at any time a day. Now, it’s time to learn more about the proven lead generation strategies for the health insurance industry. Some important medical insurance lead generation methods are listed below.

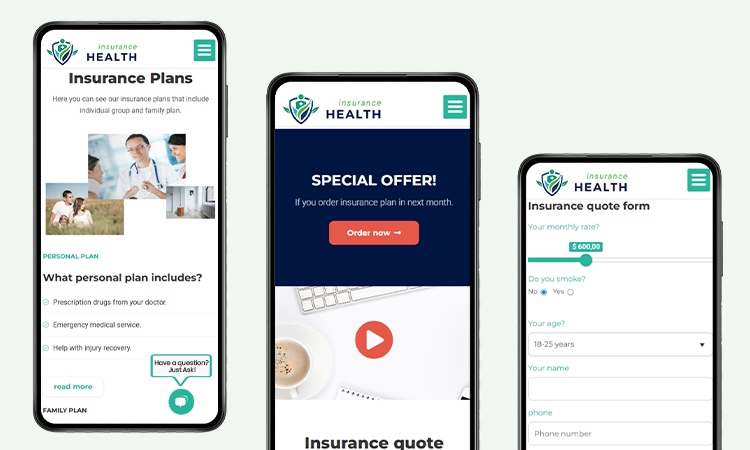

1. Make Your Website A Virtual Storefront

Your website must reflect your value and mission most impactfully. The website must serve as a virtual storefront for your health insurance service offerings and generate a sense of interest and trust in the visitors. The website must convert visitors into qualified leads for your business. Always remember that your website is the face of your health insurance business and you need to build it in the same way.

Website can play a major role in your health insurance lead generation. Make sure your website provides a seamless user experience on all types of devices. Additionally, the website must contain all the details regarding your health insurance services and beyond that a lead may look for. These are the most basic things you can do.

But every other health insurance agency can also perform these practices to make their business stand out in the competitive industry. Then, what are those things that can become your website’s USPs and offer something unique to the potential leads? Let’s have a look.

5 Crucial Elements You Must Incorporate in Your Health Insurance Website

Effective lead generation for health insurance providers will be incomplete without a robust website. The following are five major elements you must incorporate into your website to transform it into a lead-generating hub.

- Calls to Action Buttons

The right calls to action (CTAs) on your website will significantly impact the purchase decisions of your potential consumers. Clear and easy-to-follow CTAs seamlessly guide visitors on what they should do if they feel interested in your insurance offerings.

You can add CTA buttons like ‘Sign Up’, ‘Click Here for a Free Consultation’, ‘Call Now’, ‘Get Your Health Insurance Coverage’, or ‘Explore Affordable Plans Now’. Strategic placements of these CTAs throughout your website will help you deliver an exceptional user experience for your site visitors.

- Chatbot

It will allow the health insurance providers to have a real-time conversation with potential clients. Though the incorporation of a chatbot in your website is not a budget-friendly investment, it can offer long-term benefits for your lead generation strategies. If you have a good budget, you should consider it to maximize the impact of your lead generation efforts.

For instance, a potential lead has visited your website to explore your health insurance plans. When they see a chatbot pop up on your website’s homepage, it will naturally increase their interest. They are more likely to be impressed with your site’s user experience, especially when they easily get the answer to their queries regarding your insurance offerings.

- Forms

Web forms are one of the highest converting lead generation tools for the health insurance industry. It can drive exceptional website traffic and ensure client engagement. However, you must embed the web forms on specific website pages.

For example, a ‘contact form’ where interested visitors can fill up their contact information must be embedded on the ‘contact us’ page of your health insurance site. Easy-to-use web forms are a plus for your site as they help visitors conveniently provide you with their contact details and proceed with their application to start a medical insurance coverage.

- Landing Page

If your potential leads struggle to understand each of your health insurance offerings, they may not purchase them. What can you do to make all the details of your health insurance plans and policies clearly explained in a single place? You can create separate landing pages for different insurance services. It is much better than stuffing the details of all the insurance plans on the main page.

Suppose you offer ten different types of medical insurance policies. So you need to create ten different landing pages – once for each policy. However, you must ensure to create separate service pages for all the plans a policy offers. These landing pages can be a great source of a steady lead flow for your health insurance business.

- Mobile-Optimized Pages

It is important for insurance providers to optimize their entire site for mobile devices. A study claimed that over 50% of insurance searches are performed on mobile devices. You may lose a significant number of potential leads if your website doesn’t perform effortlessly on mobile screens.

Nowadays, with the increasing utilization of mobiles, most insurance consumers prefer to search online to find suitable plans. Ensure that your website pages load quickly, at least within 2-3 seconds. Otherwise, the visitor may lose interest in exploring your site further.

2. Utilize IoT (Internet of Things) to Attract Valuable Leads

IoT refers to a network of objects connected through the Internet. These objects can collect and exchange data. Two examples of IoT objects are fitness trackers and smartwatches as these gadgets collect and record a person’s health-related data.

The increasing popularity of IoT wearables has made much more data available to you. Health insurance providers can use these to customize relevant information and promote their policy plans. Agencies can excel in lead generation for health insurance with the right utilization of IoT. They can even address their prospects’ needs through their policy promotions. If you’re looking for one of the easiest ways to get leads, IoT wearables can help you in this context.

For example, there are two potential leads, X (25 years old) and Y (40 years old). Due to the age factor, Y is more prone to health risks when compared to X. But it is also possible that X lives a lethargic life and stays on unhealthy junk food, while Y prioritizes his health and maintains a healthy lifestyle. In this situation, X gets an undeserved advantage because of his age but Y becomes a victim of generalization.

But IoT-enabled devices will derive unique data. It also allows the health insurance agencies to accurately quote policies based on the actual health risks of the consumers.

3. Prioritize SEO Optimization for Your Health Insurance Business

SEO plays a huge role in ranking your health insurance website higher in search results. When it ranks on the first page of search results, it naturally grabs the attention of those who conduct online searches to find a reliable medical insurance agency. Likewise, it increases the chance of them to buy insurance plans from your agency.

From detailed keyword research to local search optimization, SEO for health insurance requires you to perform several significant practices. It will not only boost your website’s online visibility but also help you acquire new insurance leads. Let’s dive into the details to know more about the SEO best practices a health insurance representative must perform.

6 Important SEO Practices for Your Business

We have enlisted 6 most crucial SEO best practices here. Let’s dive into the details to know more about the medical insurance SEO.

Thorough Keyword Research

This is one of the initial steps of search engine optimization or SEO. You need to identify keywords and terms that can boost your website content’s visibility for relevant online searches. Suppose insurance consumers mostly use the ‘best health insurance agency’ to conduct the online search. You can make your website rank for this keyword if you optimize the site with the same. Tools like SEMrush, Ahrefs, and Google Keyword Planner can be your best companions for keyword research.

How to Use Tools for Health Insurance Keyword Research?

- Conduct research to understand the health insurance market conditions. Choose a primary keyword related to your service niche. If you provide ‘Family Floater Health Insurance Plans’, you can select the keyword ‘family health insurance’.

- Put that keyword in these tools and they will provide you with a complete list of other related phrases that you can use as the secondary keywords.

- These tools also offer you some crucial keyword insights, such as their search volumes and competition.

- You should always start your keyword optimization journey with easy-to-rank phrases with higher search volumes.

- Another best practice is to target long-tail keywords on health insurance topics. For instance, phrases like ‘health insurance’ and ‘health insurance agency’ have higher competition and you may struggle to rank for these keywords. But ‘best health insurance agency near me’ and ‘affordable health insurance plans for family’ can easily rank your website for online searches of those who are looking for the most qualified agent to take care of their insurance.

Related Resource: Healthcare SEO Keyword Strategy: How to Find and Rank for High-Intent Search Terms

On-Page Optimization

Now that you have a list of keywords you want to target through your website, it’s time to optimize your online presence. On-page optimization is the process to strategically incorporate the target keywords into the website content. Want to know how? Follow the below-mentioned process.

- Title and Header Tags – You must incorporate the primary keyword in the title of your content. Additionally, you can use your primary and secondary keywords in the headings of each section of your content. A title can be ‘How to find a good health insurance plan for senior citizens’ for a blog, where the keyword is ‘health insurance plan for senior citizens’.

- Meta title and Meta Description – These two sections generate interest among the users and encourage them to click on your content. Search engines show these two sections to a user as a result of their searches. These are the first sections that a user sees before clicking on the site URL. When you write a good meta title and meta description and incorporate your target keywords in it, it ranks your content and specific pages.

The meta title can be ’10 helpful tips to find a good health insurance plan for senior citizens’ where the target keyword ‘health insurance plan for senior citizens’ is also mentioned. And the same goes for meta descriptions.

- Image Alt Text and Site URL – It may sound indifferent to you, but the alt texts of those images you add to your website content must be optimized with your target keywords. Even your site URLs must be optimized with the keyword to make it relevant with the search results.

- Body Content – The primary keyword must be present in the first 100 words of your content. It significantly impacts the search engine rankings of your website content. Apart from this, you need to add the keywords strategically throughout your content. Keyword stuffing is one of the important factors that can negatively impact your website ranking. Try to use the keywords naturally and keep the keyword density within 1-2% of your total word count.

Off-Page Optimization

This practice also plays a major role to attract organic leads to your health insurance business. Let’s check out the steps you must follow to perform this significant practice.

- Firstly, start with a strong backlink portfolio. It’s crucial to build a good portfolio that can attract backlink opportunities for your insurance company.

- You need to partner with authoritative health and other insurance agencies to request them for backlink opportunities. When your website page links get featured on such authoritative sites, you get the opportunity to reach your business to a wider audience. Valuable backlinking also helps insurance providers convert the audiences of those authoritative sites into their own leads.

- You need to manage your social media profiles and post creative content on platforms to attract new leads.

- Never forget to respond to the online reviews you receive from your potential and existing clients. It will make them feel valued. Effective online review management can also help you to build a strong digital reputation across platforms.

Related Resource: A Complete Guide to Healthcare Off-Page SEO Techniques

Upgrade Content and User Experience

Content is the cornerstone of effective lead generation for health insurance providers. You may have the best-designed landing pages and creatively written informative blogs, but this is not enough. You need to share upgraded content on your website and social media profiles, along with other online platforms. When your content gets outdated, your website ranking will drop as well.

Fresh information, especially related to the newest health insurance policies, plans, and costs, can keep your potential leads informed. Search engines like Google prioritize fresh content and rank it higher in their results. Similarly, it’s also extremely important to upgrade the user experience of your health insurance website.

Why? Suppose a potential lead lands on your site, but it takes time to load on mobiles and the navigation is extremely complex. The prospective lead may not stay on your website in such cases and will find their way back to the search engine. They may also visit your competitor’s site for their health insurance requirements. Thus, mobile optimization, the process to reduce the page loading time, website security, and other technical aspects are vital for your health insurance lead generation.

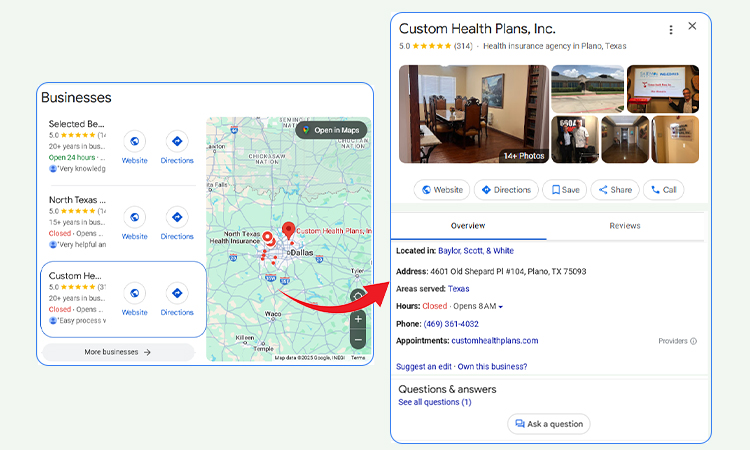

Local SEO Optimization

You provide premium health insurance policies along with affordable plans for individuals, families, and senior citizens. But most of your local prospects are still not aware of your business. Then it will be challenging for you to grow your health insurance business in the future, but not with effective local SEO optimization strategies.

The following are some helpful tips and tricks to establish a strong local market presence and enhance the local visibility of your health insurance agency.

- The first thing is to create and claim a Google Business Profile (GBP). You can list your health insurance business there and provide all the crucial NAP details of your business, such as the name of your agency, address, and phone number.

- The next step is to add the additional details that your potential leads may want to know. You can provide the details about your business hours, major plans, newly launched insurance coverages, and more.

- Local optimization also thrives depending on thorough keyword research. You can use tools like SEMrush and Ahrefs to find the relevant keywords that are mostly used by your local leads.

- Location-specific keywords can rank your website content for online searches by your local prospects who seek medical insurance providers in your service location.

- Health insurance providers can use keywords like ‘best health insurance near me’, ‘affordable health insurance plans near me’, ‘top health insurance provider in (city name)’. According to research, mobile queries that contain “insurance near me” have increased by over 100% in the past two years.

- You need to list your business in Google Maps and other online local directories as well. It will help the local leads easily locate your health insurance agency and learn more about it. You can even request your local clients to leave their genuine reviews on these directories.

Related Resources: Local SEO for Healthcare: Guide to Achieve Top Search Rankings

Healthcare SEO For ‘Near Me’ Searches: Target People In Your Locality

Authoritative Link Building

It is another important step to proceed with health insurance SEO. Backlink building can help you promote your insurance offerings through authoritative websites and reach your business to a wider audience. You can introduce your health insurance services to a new audience base and get the opportunity to convert them into potential leads. Check out how you can build high-quality backlinks from renowned sites.

- Collaborate with renowned health insurance agencies, medical professionals, and organizations to request them for backlink opportunities. You can even partner with the local insurance providers.

- Always link your website to web pages of authoritative sites as it will improve the online reputation of your health insurance business.

- You need to ensure that you get these backlinks from trusted domains with a credible DA score. But you must remember that these links come from websites relevant to your niche.

- Health insurance providers must leverage guest blogging opportunities. They can write articles and blogs for other reputable websites in the health insurance industry.

4. Consider Referrals and Schemes

Healthcare marketers can prioritize the importance of the referral system and schemes to ensure effective lead generation for health insurance industry. You may consider this method as an age-old technique to acquire new clients. But referral programs still work exceptionally for lead generation.

To start with, you need to collaborate with renowned health insurance providers and agencies for referrals. You can send them emails to request referrals from them as it will add value to your business. But, hold on! You need to remember one thing the referral system is a two-way process which means you need to refer the businesses of those from whom you’ve requested referrals.

For example, you’ve requested referrals from a life insurance agency. It can send your health insurance business’s referrals to its existing clients who have certain health issues or want policies for their loved ones. Similarly, you can refer the agency to your clients who have more potential to convert into life insurance leads.

Such meaningful collaborations often lead to long-term professional connection that helps you to get easy access to the leads of those reputable sites. You can enter into long-term to short-term contracts with other types of insurance providers and ensure a steady flow of leads for your business.

An additional factor to boost the effectiveness of your referral program is the announcement of rewards for effective lead generation. You can provide rewards like discounts on specific health insurance plans or free initial consultations to those who refer to new clients.

5. Strengthen Your Content Marketing Game

You may have heard the term ‘Content is King!’ It is rightly so as your website content has the ultimate power to attract visitors and convert them into your paying clients. The contact can generate interest and help you generate qualified leads who are more likely to purchase health insurance policies from your agency.

Whether it is for your social media pages, website, business listing profiles, or guest posting opportunities, you need content to share. For instance, you have incorporated great content for your website. When a potential lead who has interest in your policies and plans visit your website, the content makes them more interested and encourage them to take an action.

Remember these four factors when you craft content for your health insurance website.

- Your content should provide relevant information that the site visitors may seek to make an informed decision.

- The content must promote your health insurance services in a way that converts the leads into paying clients.

- Experiment with a variety of content for your health insurance website, such as videos, infographics, podcasts, and more. We suggest you go beyond blogging.

- Follow a strategic approach to distribute your content across various popular online channels.

4 Types of Helpful Content a Health Insurance Provider Can Create

The following are four major types of content you can craft to promote your health insurance and acquire new leads.

Informative Blogs to Educate Insurance Seekers

Blogging can make your lead generation journey a little easier. Because it provides you with the platform to educate and inform your target audience regarding your insurance offerings and generate their interest in your business. Blogs help you showcase your business as a credible and knowledgeable health insurance resource in the market. Additionally, it generates a sense of trust in the potential leads regarding your business.

Some of the good blog topics are:

- The benefits of health insurance for senior citizens

- Cost of premium health insurance services you offer

- Why people suffering from critical illness must consider medical insurance

- How to check health insurance policy status

- Tips to select a suitable health insurance plan

Health insurance providers must optimize these blogs with their target keywords to rank the content for relevant searches. It will help you attract new leads and convert them into your clients.

Engaging Videos to Leave a Lasting Impression

Who doesn’t love to consume information through a video? Suppose one of your potential leads lands on your website and finds an engaging video related to family health insurance plans. He/she is more likely to watch that video first instead of scrolling through the written content.

Thus it is crucial to create engaging and informative videos with high-quality videos for your website and social media accounts. You can hire a professional photographer to shoot personalized videos for your service promotions. Videos have a higher engagement rate and make the content easier to consume.

Lead Magnets to Retarget Leads

These are some of the most important content assets to help lead generation for health insurance providers. Lead magnets refer to some rewards, offers, incentives, or resources that you can provide to your website visitors in exchange for their contact information. Did you know that 50% of businesses saw an increase in conversion rates after they used lead magnets?

This way you can gain access to your potential lead’s contact number, email address, and location. Such information can help health insurance agents to remark their policy plans to the visitors. Those who visit your website are more likely to have an interest in health insurance. So you can consider an email outreach campaign and cold calling to ensure conversions.

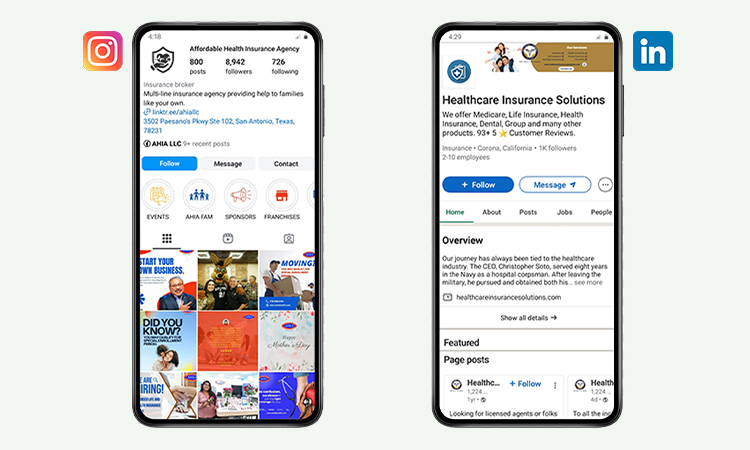

6. Make Your Health Insurance Business Thrive on Social Media

It’s extremely crucial for health insurance providers to effectively manage their social media accounts. Popular social media platforms can help them acquire a massive number of qualified leads through engaging posts. Insurance agents can target their potential clients based on demographic factors like age, location, gender, social media usage, health issues, and online behaviors.

Every social media platform has its unique audience reach. You just need to use the reach for your business’s benefits. Explore how you can utilize social media to generate valuable insurance leads and enter them into the sales pipeline.

- Do you have business pages on social media platforms? If not, you must create the profiles without wasting any time.

- However, social media page creation is not enough for your health insurance business growth. You must know how to seamlessly manage those profiles and implement social media marketing strategies to attract your potential customers.

- Start to create accounts on popular social media platforms such as Facebook, LinkedIn, Instagram, Twitter, and more. Social media leads will be interested in your health plans and insurance policies only if your social media accounts look trusted and attractive.

- Never forget to optimize the social handles with a cover picture and profile image. You can use your health insurance agency’s logo for a profile picture to make your business more relevant. Put an authentic bio to convey the purpose of your social media page.

- You can add your website link, address of your agency, and phone number to the social media accounts.

- You need to create engaging posts on your services and other relevant topics. It will garner more visibility and help you attract leads.

- Post your content on social media at a regular interval. Your potential leads may lose interest in your health insurance business if they don’t get to see interesting posts from your end for a longer period.

- You can post different types of social media content like videos, reels, carousels, texts, and images to generate qualified leads.

- Social media platforms like Facebook and Instagram allow you to run paid ads for your health insurance business promotion. You can advertise your service offerings through these ads and make your business reach wider.

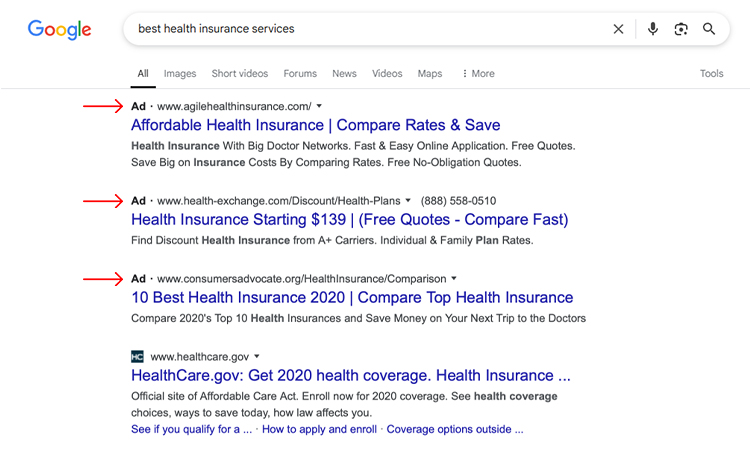

7. Run Paid Advertisements to Make Your Business’s Reach Wider

Social media platforms and search engines allow you to run pay-per-click advertisements to promote your health insurance services. Google Ads and Facebook Ads require you to pay only when someone clicks on your ads. Social media PPC ads are one of the most cost-effective ways to reach your health insurance business to a wider audience and acquire more leads.

Did you know that the average conversion rate for an insurance search ad is 5.10%? And the most outstanding part of this method is the instant visibility. Paid ads can offer your business instant online visibility that SEO takes a significant amount of time to show. If you have a good budget for lead generation, you can definitely consider this paid advertising. Explore the most important three steps to proceed with social media paid advertising.

Target the Right Keyword

This is one of those steps that offer benefits for every lead generation strategy, no matter whether it is for SEO, paid advertising, or social media management. Keywords ensure your paid ads reach the right audience who genuinely seek or need a good health insurance plan. We have already talked about the process of keyword research above.

You can use keyword research tools to find relevant phrases for your paid ads. Variation attracts and keeps the audience engaged. There are various types of ad formats that you can create to ensure effective lead generation for health insurance agencies. Some of the major ones are carousel ads, video ads, image ads, and the like. Choose what suits your requirements the most.

These ad formats require you to target and bid on keywords. Keywords like ‘best health insurance services’, ‘cost-effective health insurance for me’, ‘health insurance for senior citizens’, ‘top health insurance for family’, and ‘cost of health insurance for critical illness’ can be exceptionally beneficial.

Create Compelling Ad Copy

The ad copy must include the target keywords and reflect what you want to clearly convey through it. It must generate interest in those who are looking for affordable yet premium health insurance online. The strategic utilization of keywords in the ad copy will rank your ad higher for searches that contain the same keywords.

A compelling ad copy must make the potential leads interested in your health insurance offerings and positively influence their decision to purchase a plan from your agency. Try to make the ad copy as interesting and unique as you can. It should provide all the necessary details regarding your insurance plans and benefits.

For example, a person wants to buy a medical insurance plan and comes across your paid ad. Your ad copy must be informative enough to generate his/her interest in your policy offerings. If they feel interested in your ads, they may visit your website through it and decide to purchase a plan.

Set an Ad Budget

Budget plays a huge role in paid advertisements. You have a clear idea of the amount of money you spend to generate leads through paid ads and the amount of return on investment (ROI) you can get. Paid advertisements are quite cost-effective as they require you to pay only when someone clicks on your ad.

Health insurance providers can set a suitable budget for paid advertising and ensure the cost for every lead they acquire. The service providers can even set a daily and monthly budget for seamless management. Start with an average budget so that you don’t experience a loss in the future if your paid ads fail to create an impact. You can seek professional healthcare PPC services to generate valuable leads for your health insurance business.

Related Resource: PPC for Healthcare: Effective Strategies to Run Campaigns

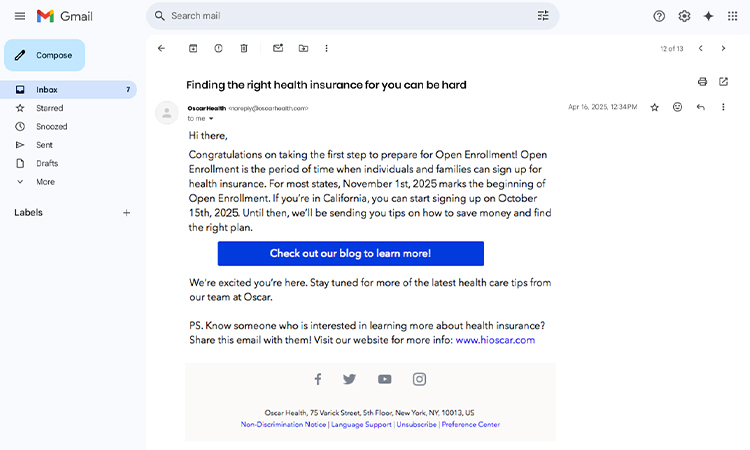

8. Promote Your Health Insurance Services through Email Marketing

Email is one of the most popular traditional media for business marketing, even in today’s digital landscape. It helps health insurance providers nurture new leads and build a strong subscriber list. Health insurance agencies can share monthly newsletters through email and perform effective promotion.

Email provides an outstanding opportunity to reach your potential leads through their inboxes. Still confused? Let’s know the process in detail.

- You can promote your health insurance services and facilities through these emails. Emails offer you the best platform to notify your subscribers about special updates of your insurance agency.

- How can your leads contact you for a consultation? You can provide instructions regarding the consultation scheduling process or explain the benefits that the potential leads can achieve through your insurance coverage. These processes help generate interest in the prospective leads and encourage them to convert.

- You can highlight in the emails why people must consider health insurance for themselves and their loved ones. They can address the pain points and offer a solution through emails to generate interest.

- Imagine that you’re busy with some business responsibilities and have forgotten to send follow-up emails to your potential leads. Nothing to worry as we’ve a solution for you. You can automate such emails to remind the potential leads to visit your office, contact your team for more information, or directly buy a health insurance plan through the website.

- Automated emails can also be used to send review requests from your existing clients. You can also send such automated emails to appreciate those who have shared positive reviews about your health insurance services.

- You can personalize your emails for specific recipients to make them feel valued. It will increase their chances to convert into your health insurance leads.

Email Marketing for Lead Generation Covers:

- Seasonal guides for health insurance purchases

- Automated follow-ups, plan renewals, and tips

- Referral contests for existing clients

- Reminders and updates on insurance loyalty programs

Related Resouces: Email Marketing for Healthcare: Everything You Need to Know

9. Consider Cold Calling and Stale Leads

Lead generation techniques like cold calling and stale leads can be fruitful for health insurance providers. But many service providers and marketers think that such techniques can irritate potential clients, but won’t solve the lead generation issue. But the reality is that health insurance agencies can leverage exceptional lead generation benefits through cold calling.

Cold calling allows a service provider to initiate a conversation with potential leads and influence their purchase decisions. They can gather crucial client data which is essential to lead generation for health insurance. You can organize a systematic database of potential leads with the help of these data insights.

Always remember that the refusal of your health insurance services is a changeable option. You can effectively utilize cold calling to initiate a conversation with those who have visited your website but didn’t purchase any insurance plans from your agency. It is your opportunity to convert these rejections into your leads.

10. Outsource and Build a Strong Professional Network

Have you realized the need to outsource your health insurance lead generation? If not, you must still consider this method to generate qualified leads for your business. Once you’re well aware of the lead generation and tactics and your efforts have started to show the desired results, you can consider that you’re on the right track. And now it’s time to turn your health insurance lead generation into an autonomous system.

It will help you get organic data with a higher conversion rate. Lead generation outsourcing also ensures that you have a significant number of good-quality leads with minimal cost involved. Now you can focus on nurturing those leads and encouraging them to purchase health insurance plans from your agency. Additionally, you can now pay more attention to the effective management of generated leads and sales conversions.

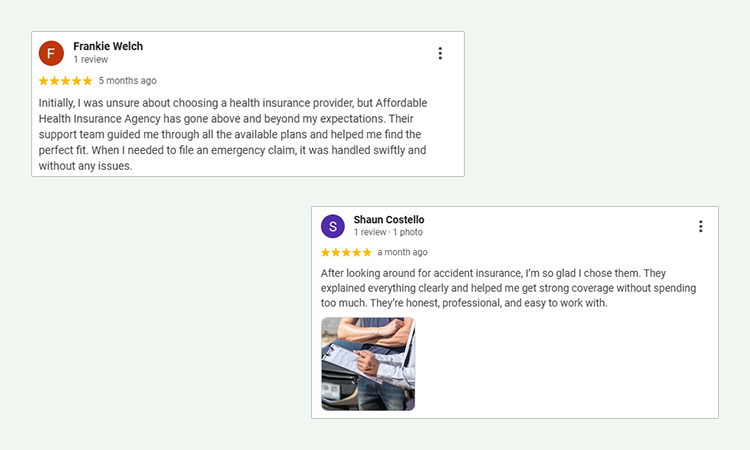

11. Solicit Reviews from Your Clients to Build a Solid Reputation

A study has revealed that 49% of online buyers consider reviews as valuable as a friend’s recommendations. They are more likely to be swayed by the reviews than ads. It requires you to have proper skills to solicit positive reviews from your clients and establish a solid online reputation.

How to Collect Reviews from Your Existing Health Insurance Clients

- You can email your clients who have recently purchased health insurance plans from your agency. Through the emails, you can politely request them to leave their genuine reviews about their purchase experience.

- You can even add links to your review sites in the emails. So that the clients can seamlessly share their reviews and feedback on your website, social media pages, GBP profiles, and other review platforms.

- You can prioritize automated emails to send review requests. We suggest you make it a part of your after-sales process for new policyholders.

- You can adopt dedicated software to collect these reviews.

- Another beneficial strategy is to cross-link the social media comments to the review platforms.

- Furthermore, you can embrace the latest marketing technologies to solicit positive feedback from your clients.

Conclusion

Health insurance is a complex field and the providers may struggle to get new clients in today’s digital age. Thus lead generation is a crucial process for health insurance providers as they have to follow various important compliances. It provides a list of benefits for the agencies and helps them generate interest among potential clients regarding their insurance offerings. But nothing can be achieved without a strategic approach.

We hope that our enlisted strategies will help you get a steady flow of qualified leads for your health insurance business. Implement our strategies and witness a noticeable positive difference in the results of your lead generation for health insurance. Lead generation is no longer a tactful job for you!

Additional Resources: